Capital Gain Bonds

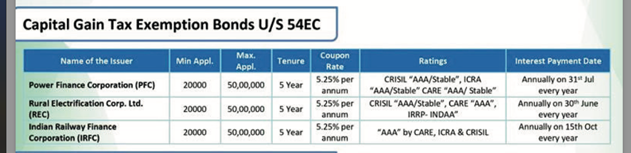

Capital Gain Bonds are a secure investment option designed to help investors save on long-term capital gains tax. These bonds are issued under Section 54EC of the Income Tax Act, allowing investors to reinvest capital gains from the sale of property or other assets, thereby deferring tax liabilities.

Capital Gain Bonds are a preferred choice for investors looking to preserve their wealth while benefiting from tax exemption on long-term capital gains. These bonds typically come with a fixed tenure and offer a stable rate of return, making them suitable for conservative investors seeking safety and steady income.

Features of Capital Gain Bonds:

Eligibility and Investment Limits:

Capital Gain Bonds provide a reliable way to safeguard your capital gains while benefiting from tax exemption. Consult a Mutual Fund Distributor to explore how these bonds can be an effective part of your investment strategy.